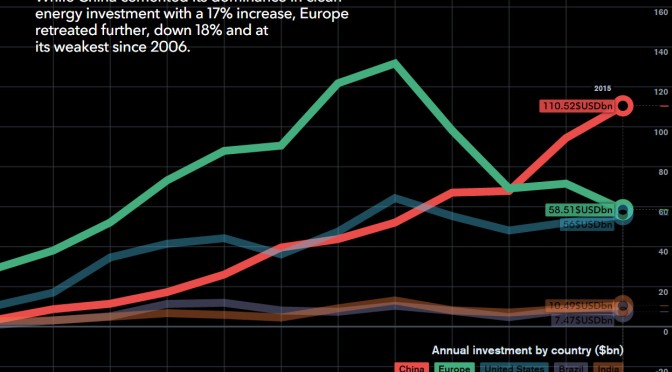

Humanity’s future, to say nothing of its prosperity, will depend on how we tackle the two central energy challenges that face us: securing the reliable supply of affordable energy, and switching rapidly to efficient low-carbon energy. Energy is vital for everyone, therefore, the states manage energy resources, in order to the addiction and fight hard to use environmentally friendly energy sources. The biggest story is in the case of renewables, it is no longer a niche. Renewable energy has become a mainstream fuel and will have a major role. Renewable energy which has been created awarness by all over the world, especially wind energy industry has been strategically important position for all states of modern world in terms of economic and politic.

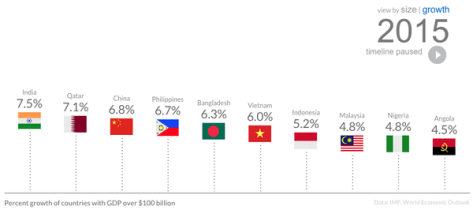

Global renewable installed capacity reached an estimated 913.48 GW in 2015. China dominated a number of renewable energy markets last year and was a global leader in terms of annual capacity additions in solar, biomass, small hydropower and onshore wind. In the global wind energy market, while China is maintaining its place, America, Germany and India continued to be the most important actors. Also, Brazil was achieved the highest growth rates in all major markets. Africa, Asia and Latin America which will become the market leaders of the next decade. The annual global wind power industry reached an installed 63,013 MW in 2015, representing annual market growth of 22%. Although final numbers for 2015 aren’t in yet, several sources, including Bloomberg and FTI Consulting, speculate that number could reach as high as 60 GW. Thus, total global capacity reached 432,419 MW at the end of 2015, representing cumulative growth of 17%.

2014 saw Asia overtake Europe as the region with the most installed wind power capacity. Much of that achievement was owed largely to China, which installed 23 GW of capacity in 2014. Early estimates indicate China may have installed 30,5 GW in 2015. Worldwide installed wind turbines meet 4% of world electricity demand. It also showed a 42% increase and had reached 371.334 MW in the 2014. Economic benefits, oil and natural gas supplying uncertainties, climate change and the urgent need for the use of environmentally friendly sourced technologies from air pollution are counted as reasons as to why the positive maneuvering in the wind energy sector.

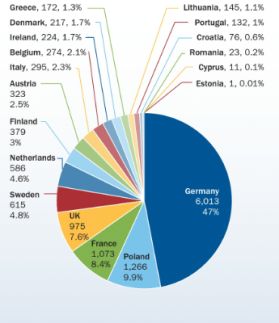

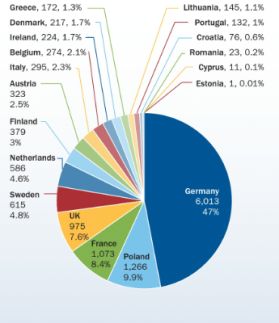

During 2015, 13,805.2 MW of wind power was installed across Europe, 5.4% more than in the previous year. 12,800.2 MW of it was in the European Union. Of the capacity installed in the EU, 9,765.7 MW was onshore and 3,034.5 MW offshore. In 2015, the annual onshore market decreased in the EU by 7.8 %, and offshore installations more than doubled compared to 2014. Overall, EU wind energy annual installations increased by 6.3% compared to 2014 installations. Germany was the largest market and Poland came second with 1,266.4 MW. There are now 16 European countries with more than 1,000 MW installed and 9 countries with more than 5,000 MW.

2016 Outlook: Wind Energy Industry yazısının devamı →